What Is Sales Tax Invoice . To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale, including the type of product or service. While invoices are generally used in all types of business transactions, tax invoices are specifically required for taxable supplies and. Goods & services tax (gst) gst invoicenow requirement. Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. A commercial invoice is a document used whenever goods are imported or exported across national borders. The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash. What is a commercial invoice?

from www.billingsoftware.in

Goods & services tax (gst) gst invoicenow requirement. A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash. To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale, including the type of product or service. A commercial invoice is a document used whenever goods are imported or exported across national borders. What is a commercial invoice? While invoices are generally used in all types of business transactions, tax invoices are specifically required for taxable supplies and. Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction.

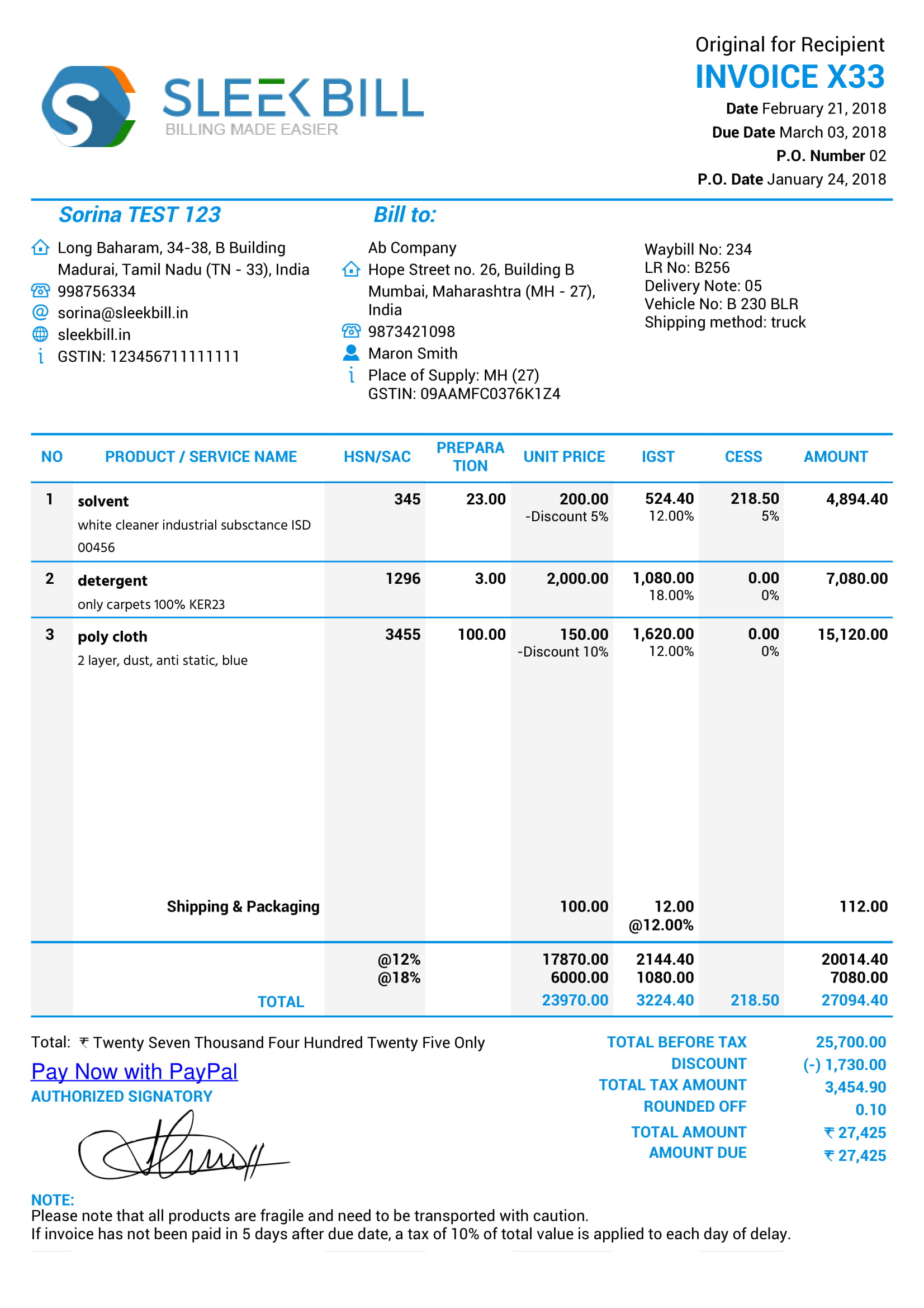

GST Invoice format

What Is Sales Tax Invoice Goods & services tax (gst) gst invoicenow requirement. A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. Goods & services tax (gst) gst invoicenow requirement. A commercial invoice is a document used whenever goods are imported or exported across national borders. While invoices are generally used in all types of business transactions, tax invoices are specifically required for taxable supplies and. The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash. To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale, including the type of product or service. What is a commercial invoice?

From learn.microsoft.com

Tax invoices Finance Dynamics 365 Microsoft Learn What Is Sales Tax Invoice Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. A commercial invoice is a document used whenever goods are imported or exported across national borders. Goods & services tax (gst) gst invoicenow requirement. A sales tax invoice is a legal document a seller delivers to a customer that details the items. What Is Sales Tax Invoice.

From semioffice.com

Sales Tax Invoice Format in Excel Free Download What Is Sales Tax Invoice A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. What is a commercial invoice? Goods & services tax (gst) gst invoicenow requirement. Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. While invoices are generally used in all. What Is Sales Tax Invoice.

From www.invoicingtemplate.com

Invoice with Previous Balance (Sales) What Is Sales Tax Invoice Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. While invoices are generally used in all types of business transactions, tax invoices are specifically required for taxable supplies and. What is a commercial invoice? Goods & services tax (gst) gst invoicenow requirement. A sales tax invoice is a legal document a. What Is Sales Tax Invoice.

From www.examples.com

Sales Invoice 17+ Examples, Word, Excel, PDF What Is Sales Tax Invoice The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash. Goods & services tax (gst) gst invoicenow requirement. A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. While invoices are generally used. What Is Sales Tax Invoice.

From whoamuu.blogspot.com

Tax Invoice Template Excel Free HQ Printable Documents What Is Sales Tax Invoice Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. A commercial invoice is a document used whenever goods are imported or exported across national borders. To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale, including the type of product or service.. What Is Sales Tax Invoice.

From www.boostexcel.com

Cash Sales Invoice Sample What Is Sales Tax Invoice Goods & services tax (gst) gst invoicenow requirement. The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash. To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale, including the type of product or service. What. What Is Sales Tax Invoice.

From restaurantlerelaisfleuri.blogspot.com

Sales Invoices What Is Sales Tax Invoice A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. While invoices are generally used in all types of business transactions, tax invoices are specifically required for taxable supplies and. What is a commercial invoice? Like a regular business invoice, a tax invoice is a document used to. What Is Sales Tax Invoice.

From www.indiafilings.com

HSN Code on Invoice What Is Sales Tax Invoice Goods & services tax (gst) gst invoicenow requirement. A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. To create a sales tax invoice, the seller issues a record of. What Is Sales Tax Invoice.

From tonykauffman.blogspot.com

Sample Sales Invoice TonyKauffman Blog What Is Sales Tax Invoice Goods & services tax (gst) gst invoicenow requirement. A commercial invoice is a document used whenever goods are imported or exported across national borders. Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. A sales tax invoice is a legal document a seller delivers to a customer that details the items. What Is Sales Tax Invoice.

From invoicehome.com

Tax Invoice Templates Quickly Create Free Tax Invoices What Is Sales Tax Invoice What is a commercial invoice? Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. While invoices are generally used in all types of business transactions, tax invoices are specifically. What Is Sales Tax Invoice.

From invoicehome.com

Tax Invoice Templates Quickly Create Free Tax Invoices What Is Sales Tax Invoice What is a commercial invoice? While invoices are generally used in all types of business transactions, tax invoices are specifically required for taxable supplies and. A commercial invoice is a document used whenever goods are imported or exported across national borders. To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale,. What Is Sales Tax Invoice.

From www.indiamart.com

Bill Book , Tax/Sale Invoice, Print Size 7 x 8.5, Rs 96 /piece M/s The What Is Sales Tax Invoice While invoices are generally used in all types of business transactions, tax invoices are specifically required for taxable supplies and. A commercial invoice is a document used whenever goods are imported or exported across national borders. To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale, including the type of product. What Is Sales Tax Invoice.

From www.boostexcel.com

VAT Sales Invoice Template Price Including Tax What Is Sales Tax Invoice What is a commercial invoice? The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash. Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. Goods & services tax (gst) gst invoicenow requirement. A sales tax invoice. What Is Sales Tax Invoice.

From www.deskera.com

What Is A Sales Invoice? A Complete Guide for Small Businesses What Is Sales Tax Invoice A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. Goods & services tax (gst) gst invoicenow requirement. What is a commercial invoice? Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. A commercial invoice is a document used. What Is Sales Tax Invoice.

From myhouseofboooks.blogspot.com

Printable Sales Invoice myhouseofboooks What Is Sales Tax Invoice The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash. Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction. A sales tax invoice is a legal document a seller delivers to a customer that details the. What Is Sales Tax Invoice.

From www.invoiceexample.net

Tax Invoice Template Australia A Step by Step Guide invoice example What Is Sales Tax Invoice While invoices are generally used in all types of business transactions, tax invoices are specifically required for taxable supplies and. Goods & services tax (gst) gst invoicenow requirement. To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale, including the type of product or service. The journal entry for sales tax. What Is Sales Tax Invoice.

From soulcompas.com

Sales Tax Invoice Format In Word What Is Sales Tax Invoice The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash. A commercial invoice is a document used whenever goods are imported or exported across national borders. To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale,. What Is Sales Tax Invoice.

From riset.guru

Sales Invoice Template Word Invoice Example Riset What Is Sales Tax Invoice Goods & services tax (gst) gst invoicenow requirement. A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their. To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale, including the type of product or service. The journal entry for. What Is Sales Tax Invoice.